TRADING

Trading encompasses trading in financial instruments on the Main Market and on WSE regulated markets NewConnect and Catalyst.

Stock market

The total value of the Electronic Order Book in shares on the WSE Main Market was PLN 205.4 bn in 2014, a decrease of 6.7% year on year. The average daily value of the Electronic Order Book was PLN 824.8 mn, a decrease of 7.5% year on year. The number of transactions was 13.8 mn in 2014, an increase of 7.9% year on year.

Value of the Electronic Order Book and block trades on the WSE Main Market in shares (PLN bn)

The turnover on NewConnect was PLN 1,435 mn in 2014, an increase of 17.1% year on year. The number of transactions on the Electronic Order Book was 865.1 thousand in 2014, an increase of 20.0% year on year.

Value of the Electronic Order Book and block trades on NewConnect (PLN mn)

The decrease of turnover was driven mainly by record-low volatility which persisted on WSE equity markets throughout 2014 and was historically low in many years, impacting the activity of investors on the exchange.

The spread between the maximum and the minimum WIG20 was greater than 1 percent at only 129 trading sessions in 2014, compared to 160 sessions in 2013 and more than 200 sessions in previous years.

Number of trading sessions within the year with the spread between the maximum and the minimum WIG20 greater than 1%

The low activity of investors on the WSE markets was also driven by uncertainty about the pension fund reform of February 2014.

However, the low investor activity due to the pension fund reform was largely driven by market uncertainty about the outcome and the ramifications of the reform in terms of the size of funds’ assets rather than by low activity of funds on the equity market.

WSE free float and share of pension funds in free float

Source: WSE, PFSA

Share of pension funds in WSE trading

Source: WSE, PFSA

The decrease of trading in shares in 2014 were also caused by low activity of foreign investors due to political uncertainty around the conflict in Ukraine.

The fixed fee on orders in the market of shares, subscription rights and ETF units on the Electronic Order Book and in block trades on both equity markets was reduced from PLN 1 to 0.20 and the fee on orders executed as part of market maker functions to PLN 0.05; the reduction took effect on 1 January 2013 and remained available throughout 2014.

In November 2013, the WSE Management Board opened a promotion for active investors on the market in equities and derivatives under the High Volume Provider (HVP) Programme. The promotion was extended to 31 October 2015. The promotion is available to legal persons investing on financial markets only on own account. Eligible for the promotion were investors who crossed the minimum threshold of turnover at PLN 5 mn per session on the equity market or 150 thousand futures and options per session on the derivatives market. The HVP promotion was designed to attract a new group of investors previously absent from WSE; their presence should in the long term help to reduce spreads and improve liquidity of the entire market.

Derivatives Market

Warsaw Stock Exchange operates the biggest derivatives market in Central and Eastern Europe. WIG20 futures have for years been the most liquid instrument that generates the highest volume of trading on WSE, representing 63.7% of the volume of trading in all derivatives in 2014 (65.4% in 2013, 80.1% in 2012).

Share of derivatives in turnover in 2014 (by volume)

In September 2013, WSE introduced to exchange trading WIG20 futures with a multiplier of PLN 20 in anticipation of gradual migration of futures with a multiplier of PLN 10 to the new contracts. 20 June 2014 was the last day of trading of WIG20 futures with a multiplier of PLN 10. Since 23 June 2014, only WIG20 futures with a multiplier of PLN 20 have been in trading.

The change of the multiplier was introduced and maintained by WSE following internal analyses and broad industry consultations involving among others the WSE Derivatives Market Committee. The main goal of the decision was to reduce transaction costs of futures to make them more attractive to investors, and to build liquidity of the futures market. The Company expected that the volume of trading in WIG20 futures could decrease in the early period after the migration. Considering the features of the new futures, including transaction costs at half those for previously listed futures, the volumes of trading should grow month by month.

The decrease in the volume of trading in futures was also driven by the record-low volatility of WIG20 throughout 2014.

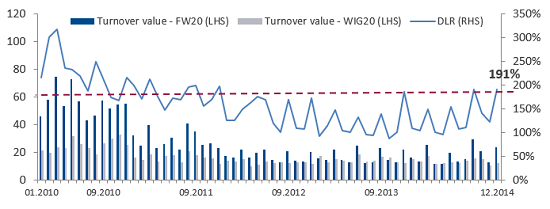

The liquidity ratio of WIG20 futures measured as the value of trading in WIG20 futures to the value of trading in the underlying was the highest since December 2011 in the last few months of 2014.

Futures liquidity ratio (DLR): value of trading in FW20 to the value of trading in the underlying

As a result of the decrease in the volume of trading in WIG20 futures, the total volume of trading in derivatives was 9.5 mn instruments in 2014, a decrease of 24.9% year on year. The number of open interest was 138.1 thou. as at 31 December 2014, a decrease of 28.6% year on year.

Volume of trading in futures, EOB and block trades, mn instruments

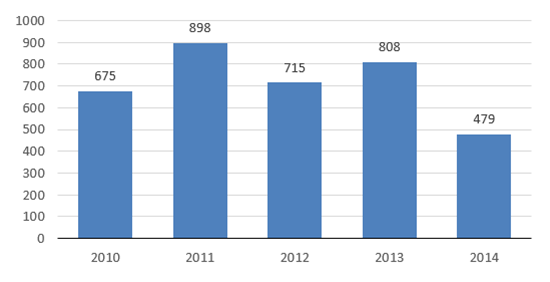

The total volume of trading in options was 479 thousand instruments in 2014, a decrease of 40.7% year on year

Volume of trading in options, EOB and block trades, thou. instruments

The following promotion fees for trading in futures were available on WSE from 1 January 2013 and throughout 2014:

- reduction of the fixed fee on index futures from PLN 1.70 to PLN 1.60;

- reduction of fees for day trading in futures on the Electronic Order Book (excluding transactions on the account of a market maker and transactions on own account of an exchange member);

- reduced fees for transactions in futures on own account of brokers.

In April 2014, the WSE Management Board opened a promotion of fees on WIG20 futures with a multiplier of PLN 20 charged on transactions as part of market maker functions for such futures. The promotion period was later extended until the end of December 2014. As a condition of eligibility for the promotion, market makers had to reach a minimum threshold of the volume of trading set per each month as follows:

- 10,000 futures in May 2014,

- 15,000 futures in June 2014,

- 30,000 futures in July and in August 2014,

- 40,000 futures in September and in October 2014,

- 50,000 futures in November and in December 2014.

The goal of the promotion was to stimulate trade in WIG20 futures with a multiplier of PLN 20 in view of the planned delisting of WIG20 futures with a multiplier of PLN 10 as of 23 June 2014.

WSE also offered promotional fees charged from exchange members on trade in bond futures and WIBOR futures at zero in 2014.

Debt Instruments Trading System Catalyst

Catalyst is comprised of regulated markets and alternative trading systems and is operated on the trading platforms of WSE and BondSpot, a subsidiary of WSE. Catalyst is designated for debt instruments: municipal, corporate and mortgage bonds, and its architecture makes it compatible with issues of various sizes and different characteristics as well as suitable to meet the needs of various investors: wholesale and retail, institutional and individual investors. Retail Treasury bonds are also listed within Catalyst.

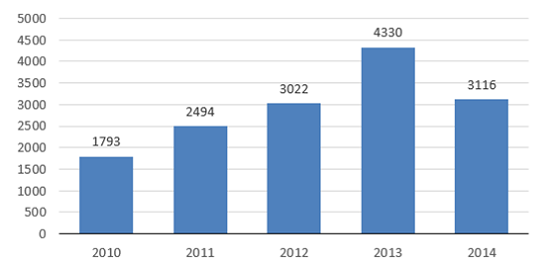

The value of the Electronic Order Book in non-Treasury instruments on WSE markets operated within Catalyst was PLN 1,728 mn in 2014 as compared to PLN 2,206 mn in 2013 (a decrease of 21.7%), and the value of block trades was PLN 776 mn in 2014 as compared to PLN 1,560 mn in 2013. The total value of trade in non-Treasury and Treasury instruments on Catalyst was PLN 3,116 mn in 2014 as compared to PLN 4,330 mn in 2013, representing a decrease of 28.1%.

A promotion on maximum fees charged for introduction of debt financial instruments denominated in EUR into trading on the regulated market or an alternative trading system was open from April to September 2014. The maximum fee was reduced from PLN 30 thou. to PLN 15 thou. in the promotion. In addition, the WSE Management Board introduced a promotion fee for listing of debt financial instruments denominated in EUR in the regulated market or an alternative trading system at zero.

Value of trading on Catalyst, PLN mn

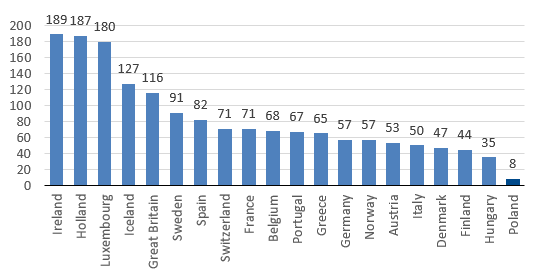

In the Company’s opinion, Catalyst still has a high growth potential, which is reflected in a relatively low level of bond debt issued in Poland in relation to GDP. The aggregate indebtedness of Polish companies and financial institutions under debt instruments (with maturities over 1 year) issued on the local and international markets represented 8% of the nominal GDP as at 30 September 2014.

Bonds issued by financial and non-financial institutions to GDP (%)

Source: Fitch

Catalyst also has a potential created by regulatory requirements following the pension fund reform of February 2014, which bars funds from investing in Treasury bills and other debt instruments guaranteed by the State Treasury, which naturally turns them to the corporate bond market. Further opportunities for Catalyst may open with the option of direct participation of banks in the market (single banking licence) as well as the promotion of ratings, largely supported by the Institute of Analysis & Rating established within the WSE Group.

Treasury BondSpot Poland

Treasury BondSpot Poland (TBSP) offers trade in Treasury securities (Treasury bonds and bills). As a rule, all non-retail Treasury bonds denominated in PLN and EUR and Treasury bills are introduced to trading.

In 2014, TBSP held the status of electronic market within the Treasury Securities Dealer System, the reference platform of secondary trading in Treasury debt (the selection is made once every two years by the Treasury Securities Dealer System and approved by the Minister of Finance).

Development of the TBSP product offer in 2014 included the implementation of new functionalities: MidPrice Order Book and Striker Price, as well as institutional investor access to the cash market based on Request for Quote (RFQ). In conditional transactions, tri-party repos were launched in order to provide a mechanism securing transactions with services of a tri-party agent (KDPW acts as the agent) and to create conditions necessary to extend the maturities of repo transactions. In 2014, the price list was amended to the extent of cash transactions of market makers, effective as of 1 January 2015.

In 2014, the activity of market participants was driven both by global factors and directly by developments on the Polish financial market. The local bond market was impacted by global capital flows following the activity of the biggest central banks aimed at stimulating growth and preventing the effect of deflation (on the one hand, expectations that the Fed will reduce quantitative easing; on the other hand, the QE policy implemented by the Bank of Japan and expectations that the European Central Bank will do the same), as well as local factors (interest rate cut expectations followed by decisions of the Monetary Policy Council). These activities determined bond yields and prices on the base markets, which impacted yields and prices on the local market. The falling yields of Polish bonds were also driven by interest rate cut expectations followed by decisions of the Monetary Policy Council. The changes implemented in the pension fund system were an important factor driving the value of trading on the bond market. The changes to the pension fund system effective as of early February 2014 put an end to the transactional activity of this group of institutional investors in Treasury securities, affecting the turnover in the interbank segment. Moreover, the Ministry of Finance largely reduced its activity as an issuer on the primary market in the latter half of the year, which affected the value of trading on the secondary market.

In 2014, the value of cash transactions on Treasury BondSpot Poland was PLN 327.4 bn (a decrease of 5.6% year on year) and the value of conditional transactions was PLN 439.2 bn (a decrease of 11.8% year on year). Despite the decrease in the value of cash transactions in 2014, the share of transactions on the TBSP platform in outright transactions on the Treasury securities market increased. The share of outright transactions in bonds on the TBSP platform in the total value of outright transactions on the bond market was 11.1% in 2014 (data for January-November) compared to 9.1% in 2013 and 12.1% in 2012. The share of conditional transactions on the TBSP platform in conditional transactions on the bond market decreased to ca. 5.1% in 2014, compared to 6.0% in 2013 and 8.3% in 2012.

As at 31 December 2014, TBSP had 33 market participants (banks, credit institutions, investment firms and one pension fund).

Other Cash Market Instruments

Apart from shares and debt instruments, the WSE cash market lists also structured products, investment certificates, warrants and ETF certificates.

In total, WSE listed 774 structured products, 31 investment certificates, 3 ETFs and 75 warrants at the end of 2014, as compared to 550 structured products, 37 investment certificates, 3 ETFs and 72 warrants at the end of 2013.

Number of structured products, investment certificates, ETFs and warrants listed on WSE, as at 31 December

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

|---|---|---|---|---|---|---|

| Structured products (certificates) | 744 | 550 | 327 | 178 | 124 | 54 |

| Structured products (bonds) | 4 | 7 | 16 | 28 | 24 | 16 |

| Investment certificates | 31 | 37 | 58 | 60 | 58 | 50 |

| ETFs | 3 | 3 | 3 | 3 | 1 | - |

| Warrants | 76 | 72 | 68 | 90 | - | - |

The value of the Electronic Order Book in structured products amounted to PLN 560.5 mn in 2014 compared to PLN 280.7 mn in 2013 and almost doubled year on year (99.8%). The value of trading in ETF units was PLN 103 mn in 2014 compared to PLN 169.4 mn in 2013. The value of trading in investment certificates increased by 53.2% to PLN 72.1 mn in 2014.

LISTING

Listing encompasses admission and introduction to exchange trading and listing of securities on the markets organised and operated by the Group.

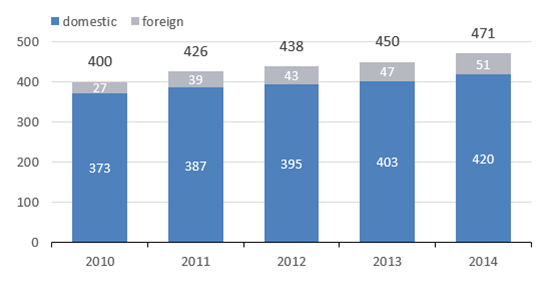

WSE ended the year 2014 with 902 companies listed in aggregate on the Main Market and in the alternative trading system on the NewConnect market, including 61 foreign issuers (895 listings including 58 foreign issuers at the end of 2013).

Number of domestic and foreign companies – Main Market

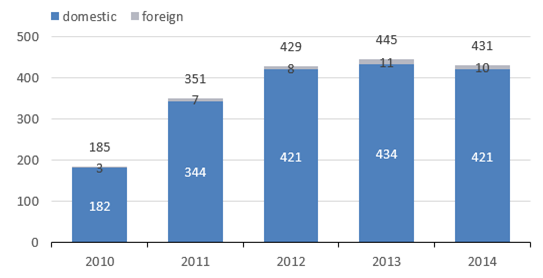

Number of domestic and foreign companies - NewConnect

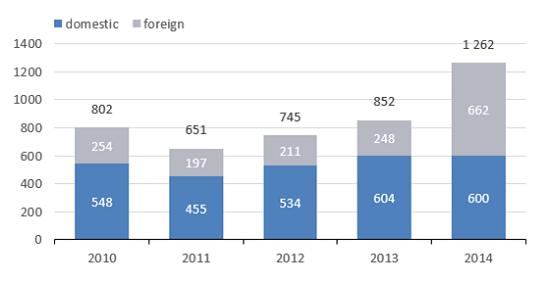

The total capitalisation of domestic and foreign companies on WSE’s two equity markets was PLN 1,262 bn at the end of 2014[1] compared to PLN 851.8 bn in 2013.

Capitalisation of domestic and foreign companies – Main Market and NewConnect (PLN bn)

There were 50 IPOs on WSE’s two equity markets in 2014 (including companies which transferred from NewConnect to the Main Market), compared to 65 IPOs in 2013. The total value of IPOs on WSE’s two equity markets was PLN 1.4 bn and the value of SPOs was PLN 3.6 bn in 2014.

Value of IPOs and SPOs – Main Market and NewConnect (PLN mn)

Four foreign companies were newly listed on the Main Market in 2014, representing 14.3% of the total number of 28 new issuers.

The number of new listings on NewConnect decreased in 2014. There were 22 new listings, including 3 foreign companies, compared to 42 new listings in 2013. Ten issuers listed on the alternative market transferred to the WSE Main Market.

With 431 listed companies (including 10 foreign listings), the capitalisation of NewConnect was PLN 9.1 bn at the end of 2014.

The Catalyst market, which celebrated its fifth anniversary in 2014, was an important driver of growth for the market of non-Treasury debt instruments in Poland in yet another year of its operation. The nominal value of non-Treasury debt instruments listed on Catalyst was PLN 64.1 bn at the end of 2014, an increase of 8.7% compared to 2013 year-end.

Catalyst listed 496 series of non-Treasury debt instruments at the end of 2014, and another 9 series were authorised.[2] Issuers whose instruments were listed at the end of 2014 included 20 local governments, 148 enterprises and 22 co-operative banks.

Including the State Treasury, the number of issuers on Catalyst was 193 at the end of 2014, compared to 176 at the end of 2013. The total nominal value of non-Treasury and Treasury debt instruments listed on Catalyst was PLN 544.6 bn at the end of 2014 as compared to PLN 619.1 bn at the end of 2013.

[1] The increase of capitalisation was mainly driven by the IPO of Banco Santander in December 2014; the company’s capitalisation is ca. PLN 350 bn.

[2] Authorisation of bonds on Catalyst involves acceptance of the issuer’s disclosure obligations set out in the Catalyst Rules and registration of the issue in the Catalyst information system.

INFORMATION SERVICES

WSE collects, processes and sells market data from the markets operated by the WSE Group. The status of WSE as the original source of information on trading and its strong brand and diversified business activity within the WSE Group enable the Company to successfully reach various groups of market participants with advanced information adjusted to individual needs.

The main clients using information provided by WSE are specialised data vendors who deliver the data made available by the Company in real time to investors and other market participants. Amongst the vendors there are information agencies, investment firms, internet portals, IT companies and other entities.

As at 31 December 2014, the Company’s information services clients were 58 data vendors, including 31 domestic and 27 foreign ones, with nearly 240.3 thousand subscribers (including over 15.1 thousand subscribers using professional data feeds). The number of clients changed only moderately year on year but the geographic distribution of clients suggest a growing share of foreign vendors. At the end of 2014, WSE had data vendors in such countries as the United Kingdom, the USA, France, Germany, Switzerland, Austria, Denmark, Sweden, Norway, Ireland, the Netherlands, Cyprus and Slovakia.

The commodity market data service was added in 2014 to WSE’s offer of real-time data from the WSE and BondSpot markets pursuant to a co-operation agreement with the Polish Power Exchange. The expansion of WSE’s offer according to the WSE Group’s strategy of creating revenue synergies within the Group resulted in a moderate change in the number of clients in this business line in 2014. However, in the opinion of the Company, commodity information services have a large potential in the coming years, not least in view of the planned introduction of commodity derivatives settled in cash into trading by PolPX.

In addition to quotation data, the Company also provided data vendors in 2014 with reports of issuers listed on NewConnect and Catalyst.

The Company’s information services also include:

- delivery of WSE statistics and indicators;

- services for licensees issuing financial instruments with the use of WSE indices as underlying instruments;

- licences on WSE data for use in the calculation and publication of clients’ proprietary indices;

- calculation of indices for clients;

- licences for television stations using real-time data feeds for limited presentation in public financial programming.

The Company is also engaged in advanced work to add services for new client groups to its offer.

Number of data vendors and subscribers, as at 31 December

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

|---|---|---|---|---|---|---|

| Number of real-time data vendors, including: | 58 | 58 | 58 | 57 | 52 | 50 |

| - local | 31 | 34 | 37 | 37 | 33 | 32 |

| - international | 27 | 24 | 21 | 20 | 19 | 18 |

| Number of real-time data subscribers (thou.), including: | 240.3 | 261.9 | 288.1 | 327.3 | 307.2 | 186.7 |

| - number of subscribers using professional data feeds | 15.1 | 16.2 | 16.3 | 19.1 | 20.6 | 20.7 |

| Number of licensees using WSE indices as underlying instruments of financial products | 16 | 17 | 17 | 18 | 16 | 15 |